This week on the Ministry of Hemp podcast, we meet a cannabis marketing expert and look at the future of CBD and the hemp industry.

Our host Matt talked with Connor Skelly, head of marketing for the Brightfield Group which specializes in cannabis marketing. They talk about the cannabis year in review, how COVID-19 devastated the market but also made it stronger, trends in new cannabinoids, and how both successful and budding young companies are weathering the storm.

Send us your hemp questions and you might hear them answered on one of our Hemp Q&A episodes. Send your written questions to us on Twitter, Facebook, [email protected], or call us and leave a message at 402-819-6417. Keep in mind, this phone number is for hemp questions only and any other inquiries for the Ministry of Hemp should be sent to [email protected]

Be sure to subscribe to the Ministry of Hemp podcast on Spotify, Apple Podcasts, Podbay, Stitcher, Pocketcasts, Google Play or your favorite podcast app. If you like what your hear leave us a review or star rating. It’s a quick and easy way to help get this show to others looking for Hemp information and please, share this episode on your own social media!

If you believe hemp can change the world then help us spread the word! Become a Ministry of Hemp Insider when you donate any amount on our Patreon page!

You’ll be the first to hear about everything going on with our special newsletter plus exclusive Patron content including blogs, podcast extras, and more. Visit the Ministry of Hemp on Patreon and become an Insider now!

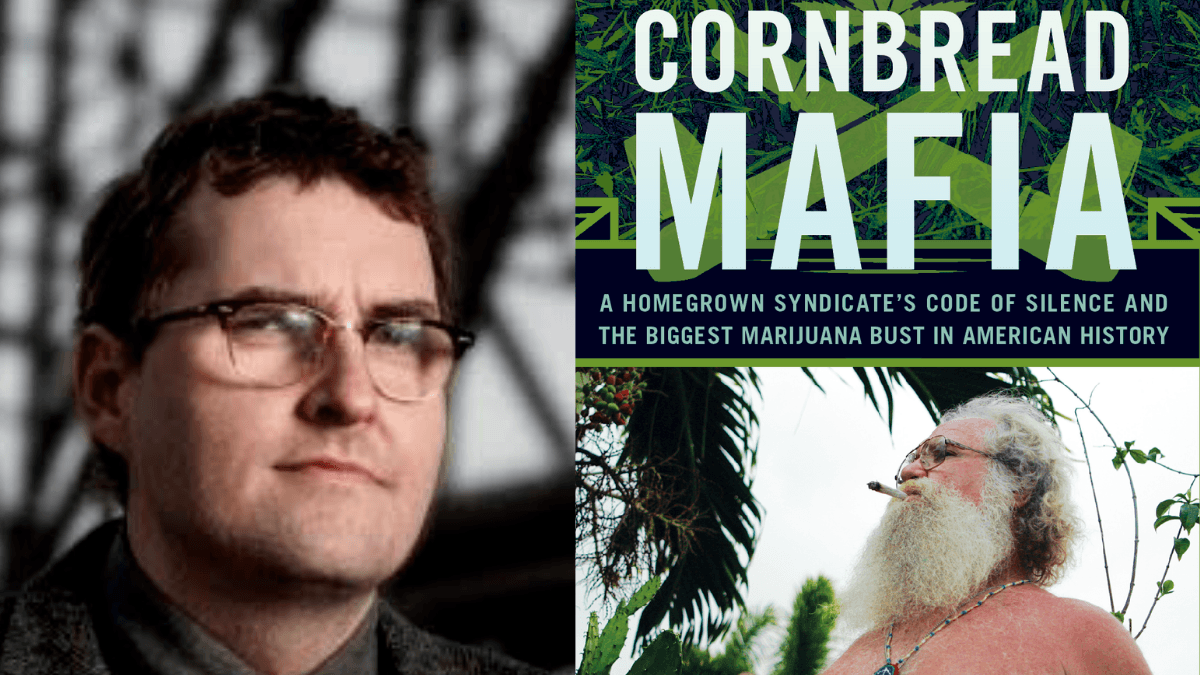

Connor Skelly, marketing director at the Brightfield Group, joined the Ministry of Hemp podcast to talk about cannabis marketing and the future of the hemp industry.

Connor Skelly, marketing director at the Brightfield Group, joined the Ministry of Hemp podcast to talk about cannabis marketing and the future of the hemp industry.

Below you’ll find the complete transcript of episode 61 of the Ministry of Hemp podcast, “Cannabis marketing and the future of CBD”:

Matt Baum:

I’m Matt Baum, and this is The Ministry of Hemp Podcast, brought to you buy ministryofhemp.com, America’s leading advocate for hemp and hemp education.

Matt Baum:

Welcome back to The Ministry of Hemp Podcast. This is Tuesday. It’s Election Day. And as I sit here recording this, I have no idea what is happening with the election yet. And I’m not going to lie, I’m a little nervous, I voted by mail. I didn’t see a whole lot of people in line today, so I think a lot of people in Nebraska also did. But, I am a little anxious. And I’m taking my CBD today to help me stay calm, collected, and head in the game. I hope you guys all had a chance to vote, I hope you’re not as anxious as I am, but if you are, it just so happens that CBD is great for Election Day anxiety, as well as a lot of other types of anxiety.

Matt Baum:

But we’re not here to talk about that. Today we are going to talk about CBD, but we’re going to talk about the marketplace as a whole. Today I’m talking with Connor Skelly.

Connor Skelly:

My name is Connor Skelly, and I’m the marketing director at Brightfield Group.

Matt Baum:

The Brightfield Group is a marketing group that supports the most comprehensive data in CBD and cannabis out there today. They’ve been tracking this market pretty much since its birth. Which, as you’ll here, has been pretty exciting for a guy like Connor. Now there’s still a lot to learn, but just like any other product, CBD, cannabis, is sold to people. And you got to market to people. It’s a very cool conversation about the state of the cannabis market today, dealing with COVID, the election and whatnot, and what it’s going to be like next year. Here’s my conversation with Connor Skelly of the Brightfield Group. We opened with some discussion of 2020, the cannabis market year in review.

Connor Skelly:

Zooming out, over the course of this year, this very long year-

Matt Baum:

Yeah, it has felt pretty long, hasn’t it?

Connor Skelly:

It’s been a pretty long year. It’s the same amount of days as last year, but it still seems a lot longer.

Matt Baum:

I don’t know if that’s true, to be quite honest. So, at this point.

Connor Skelly:

So what has happened to a lot of these CBD brands is, they’ve had to significantly adjust their marketing strategy, and their digital strategy, and how they go to market. When COVID hit, across most of the United States in March, these brands who were predominantly in brick and mortar saw significant declines in sales.

Matt Baum:

Yeah, just like everybody, right?

Connor Skelly:

Yeah. So not just with them, but everywhere. And even online first CBD brands, they saw a hit too, as consumers and people across the country were evaluating their budgets, many people were getting laid off, it was just a tough economic time for, really every sector. And the ones who were able to adapt very quickly were those online first brands, the ones who had strong D2C model in place already, the ones who have already been setting up strong marketing channels online, where everyone was just online even more.

Connor Skelly:

And so over the course of the past six, eight, seemingly 100 months, a lot of these company’s brands who may have had strong distribution networks able to get into brick and mortar very quickly, they are now adapting, strengthening their D2C models, trying to play catch up on their digital marketing strategies.

Matt Baum:

So you’ve been working with a lot of these brands I’m guessing.

Connor Skelly:

Yeah.

Matt Baum:

You work in strategic data and insights. I’m looking at your website right now. It’s a good looking site by the way.

Connor Skelly:

Thank you.

Matt Baum:

That’s coming from a guy that helped people with broken websites, so.

Connor Skelly:

I appreciate that.

Matt Baum:

What is the strategy when something like COVID hits? Because you would think, a lot of people would think, well, you said brick and mortar stores have had trouble, but online brands, I mean, what’s the problem there? They should be fine, right? I mean, they’re online. And CBD’s the hottest thing in the world. Is it still as hot as it was? Is it just COVID that is pushing this stuff back right now? Or are there other things that are causing issues as well?

Connor Skelly:

So one of the larger things in the CBD industry was price compression. So in Q1 a lot of… With the steep decline of hemp going down, it’s going down and down more and more, CBD brands wanted to be able to reach more consumers by doing 30, 40% price cuts across their entire portfolio.

Connor Skelly:

And so seeing that in Q1, a lot of people not… No one knew that COVID was coming, they saw significant revenue declines, even though a lot of that sales volume still remained relatively strong going into Q2. So back in July we reforecasted our US CBD market sizes. And that was one of the biggest contributors to it, was that, even though sales volume was still going strong, the CBD brands were adjusting their pricing strategies, and their pricing models, and it just brought everything down.

Matt Baum:

Right. Which, good for the consumer, but scary for the actual brand, right?

Connor Skelly:

Absolutely. Yeah. It makes revenue forecasting significantly harder to do. And it just makes it much harder. That situation in Q2 was… It just made it significantly harder to predict for the future. Even some of the top brands who were performing really well last year and early this year, they’re in a tough spot.

Matt Baum:

Do you think that this is something, like the price that we’ve seen, the declines, because I have seen that through a lot of brands, have drastically been cutting prices, do you think that’s something that stays when things start to rebound? Is this going to become the new normal? Because it does seem like, to me, just dealing with a lot of people that have questions about CBD, and CBD brands and whatnot, it seems like the biggest entryway blockage is price. And as price comes down that seems to get more people buying, and checking it out, and it helps more people. Do you think prices stay down after this? Is this a new normal?

Connor Skelly:

Yeah. Yeah. Prices should roughly stay the same, if not go lower on some of those products that are more easily available to produce like capsules, for example. And there have been a lot of brands doing big awareness grabs. From a marketing standpoint, being able to do these large awareness grabs, just to get consumers in the top of your funnel, giving away free product for 30 days, or whatever it is, for a 30 day supply. And just a way to get those people in on a relatively low cost has been really popular.

Matt Baum:

Definitely. I’m sure.

Connor Skelly:

And what we’re seeing in our data is, consumers are… They’ve cared about price for a long time, right? Price and education have been some of the top things. And what they look for in brands is trustworthiness and high quality products. And that is now quickly becoming table stakes. And so if that’s the standard for a CBD brand, how else can you further differentiate yourself. And so that’s where we’ve seen a lot of these online first brands over the last few months really try to differentiate themselves through their marketing.

Matt Baum:

Sure. So who comes to you? Who do you work with? What kind of brands are you working with? Big huge brands? Little brands? All kinds of brands? Who is coming and looking for this?

Connor Skelly:

All kinds. Yeah, all kinds. And we work with many of the top CBD brands in the space. The top cannabis brands as well, the ones with CBD products. And we’re hearing it from all angles. The top brands, our experience and challenges, surely prior to COVID we were tracking 3,500, roughly, CBD brands.

Matt Baum:

Wow.

Connor Skelly:

In the US alone.

Matt Baum:

Wow.

Connor Skelly:

So that is… I mean, any industry like that is due for a shakeout, right?

Matt Baum:

Of course, of course.

Connor Skelly:

You can’t have a healthy industry with that kind of saturation. So it was due for a lot of these small brands to kind of leave. And COVID accelerated that significantly. And so the smaller brands who were able to stick around were the ones that were often online first, the ones that were brand first, the ones that were customer first, consumer-centric, they were thinking like a real company. Where at the end of 2019, or even just at first when the Farm Bill got passed in 2018, you just had a lot of bad actors in the space that were just trying to sell this product.

Matt Baum:

Yeah, definitely.

Connor Skelly:

And a lot of times it was just olive oil. So now that we’re past the curve of disillusionment, we’re kind of passing sort of this massive-

Matt Baum:

Would you say that bubble has burst? Would you say that? I mean, just like any other marketing, it gets huge, it bubbles up, everybody wants a part of it, we’re all going to get into it, there’s bad actors, there’s good people, and then bang. It pops. And you do shed a lot of those bad actors because they go, “Well, what’s the point right now?” You also shed, unfortunately, some really cool people who just couldn’t survive. But ultimately, it does seem like it’s better for the business, right, in the end?

Connor Skelly:

Ultimately, yes, right? Ultimately, overall for the industry, it does strengthen it. And this was going to happen anyways, and COVID just accelerated it. Where, another possible consolidation point, or another sort of come to Jesus moment for the CBD industry will be when the FDA provides more guidance on specifically in decibels. Because then that will shake up the space a lot more, and they have since accelerated their guidance a bit, which is promising-

Matt Baum:

Definitely.

Connor Skelly:

… especially for a lot of these large CBG companies that are holding out to make a stronger decision. But once those companies come in, they’re going to be looking at brand acquisitions, they’re going to be looking at doing their own product innovation, and to your question around what else is happened this year, innovation did not slow down. Companies are launching new products, they never stopped doing that.

Matt Baum:

It does seem like that.

Connor Skelly:

Adding in minor cannabinoids in their products, trying to find new ways to position, thinking much more strategically about how they can get in front of different types of consumers for different need states. That really, that didn’t slow down at all as a result of COVID. So-

Matt Baum:

So what’s hot right now? Like you said, there’s all kinds of new innovation. They’ve been forced to innovate, basically, because there’s so many other companies. What’s hot right now? What’s the new hot cannabinoid if you will?

Connor Skelly:

CBN is kind of the biggest one. With all these cannabinoids, the jury’s still out on how conclusive the science is around all of it. And these CBD brands, they’ve been very careful about making health claims, and that’s kind of the biggest number one thing that you shouldn’t do. [crosstalk 00:11:31], and-

Matt Baum:

Right. The good ones have been very careful about it. There’s plenty of bad ones that have not been very careful about it though.

Connor Skelly:

Right, right. And with CBN it’s being positioned for sleep more and more. It does have properties that allege to help with insomnia, and overall sleep issues. So various brands have been launching products with CBD and CBN, with CBD, CBN, and melatonin, to further use those kind of functional ingredients, to not only help position our product when people have that need state of, I need to improve my sleep. And then they go out and find that product. Melatonin can help with that.

Connor Skelly:

But now we’re seeing more of products with just CBN and CBD. And so they’re taking out that functional ingredient from it, and now just sort of strengthening the positioning of CBN as a potential sleep aid.

Matt Baum:

Yeah. I’d seen a lot of those. I’ve actually talked to a few companies that are really pushing CBN. And I got to tell you, I really like it, personally. I’ve found a couple that work really well, and I’ve found a couple that didn’t do anything. So, I mean, you got to look around.

Connor Skelly:

Yeah, that’s how it goes, right? And kind of getting at that point around trial, right? Trying out different products, brick and mortar is fantastic for that. And that’s where a lot of these innovations have capped launching. And I expect that a lot of those innovations will ramp up faster as brick and mortar opens back up again.

Matt Baum:

Definitely. Definitely.

Connor Skelly:

Because it’s a great avenue to do trial packs for customers just to grab a quick thing that may be on sale for them to try out. And we’re starting to see that more in the earliest channels that we saw that in during COVID was convenience and the C stores and gas stations. Those [crosstalk 00:13:23]-

Matt Baum:

Before we go a lot further with this, tell me a little bit about you guys, about what you do with the Brightfield Group. Where are you located? How do you find clients? Do they come to you? What do you guys do exactly?

Connor Skelly:

So we are a market research firm. And consumer insights firm. And what we do is, the core value of our business is our ability to implement a multi-source methodology to get as much information around emerging markets as possible. And so with CBD and cannabis, we have been able to leverage multiple sources. So on the research side, doing the desk research, doing the modeling out for market forecasts, and talking with… Doing various in-depth interviews with retailers, and brands, and manufacturers, and everyone across the supply chain, as well as a partnership network with various brands so we can understand sales a lot more.

Connor Skelly:

And then on the tech side, being able to do digital menu audits across retail, social listening, our consumer survey is integrated with social media so we can better tie usage, and attitudes, and psychographics, and product usage, to actual social media behavior. So taking all of these inputs and using a research team and a team of subject experts to look at this, and being able to provide the most robust view of the industry possible.

Matt Baum:

So why strictly cannabis? I mean, you guys are obviously marketing nerds, I can tell by the way you’re talking.

Connor Skelly:

I can’t help it, I can’t help it.

Matt Baum:

No, yeah.

Connor Skelly:

Well, this approach to research works really, really well in emerging markets when you just don’t have the data elsewhere.

Matt Baum:

That’s exactly what I thought you were going to say. This is pretty much a baby market. I mean, we now have about, what? Five, eight good years of marketing research on this basically?

Connor Skelly:

Mm-hmm (affirmative).

Matt Baum:

Does that-

Connor Skelly:

Yeah, I mean-

Matt Baum:

Is that more difficult? Or is that easier to deal with?

Connor Skelly:

Wait, what do you mean?

Matt Baum:

The fact that it’s so young. Is it easier because you can see it and track it from its birth? Or is it more difficult because you’re not looking at something like, I don’t know, pork belly futures or something, that have been around since before the Dust Bowl.

Connor Skelly:

It’s a bit of both, right? It’s extremely difficult because you don’t have the traditional data that you would to track, say, general beverage companies, or beverage industries, right? You don’t have the Nielsen data, or the Mintel, or the SPINS data that has been tracking this stuff in store for years, and then after a few years they’ll put into their consumer surveys, and then you finally start to get more consumer data about that. The time hasn’t happened for us to get that.

Connor Skelly:

So our approach to it is, collecting as much data from as many sources as possible, and creating a larger picture that way. And for markets like CBD and cannabis, that really is the main way that you can do it, because you’re going to miss out, point of sale for CBD, for example, a lot of it happens online. And so you have a huge data gap there. A lot of it happens in independent pharmacies. And so a lot of them don’t have the point of sale infrastructure.

Matt Baum:

Yeah. A lot of them are dealing in cash, because they don’t even have credit card usage that they can work with right now, so.

Connor Skelly:

Right, exactly. So that’s our approach to tracking these markets. And consistently, we were the company that had originally predicted the CBD boom in 2019. And well before the Farm Bill was passed. And it was all under the hypothesis that the Walgreens and the CVSs of the world, they’re going to see the opportunity and they’re going to want to get in on it. And we did see that. FDA, COVID, those are our big blockers to it. But the way that we approach this stuff, it’s worked really well.

Matt Baum:

So let’s take, best case scenario. COVID gets cleaned up, FDA goes, “All right. We figured our crap out. Here’s how it works.” And they spell out the rules. What is the next big thing for CBD, for cannabinoids?

Connor Skelly:

Well, this has been going on for a couple years, maybe even more than that, it’s such a large industry. But looking at… Well first, I’ll look at CBD and where it’s being used as, and being positioned as just an ingredient that can fit into all types of different categories.

Matt Baum:

Right. Food, drink, capsules, tincture, whatever.

Connor Skelly:

Yeah. And that’s happened, right? These CBD brands, they’ve done a very good job of creating robust product portfolios around CBD. As the category expands, it will be… And more of these larger players get into the space, ingredients companies, CBG companies, it will continue to be used as an ingredient to focus on wellness positioning, which is a big topic, right? Wellness is a huge category. Something like four trillion dollars is the global wellness market, or something ridiculous.

Matt Baum:

And it can mean like anything almost, it seems like.

Connor Skelly:

Right. Even from spas to my FitBit to CBD, right? And so where I see this going is, these companies will begin to use CBD more and more in a wellness positioning, and really targeting those need states of consumers under, for many companies, where it makes sense for their brand, under a wellness umbrella. And there’s a lot that you can do with that, right? There is a lot of these brands moving more and more into the wellness space because there’s only really so high you can go for a growth potential in CBD.

Matt Baum:

Unless you want to end up like Kratom, in ever gas station, or something.

Connor Skelly:

And there’s always companies like that, right? There’s always companies that they stay in their lane, they know what they’re doing, and they do it really well. And there’s nothing wrong with that. And there’s a lot of companies out there that want to continue to grow.

Matt Baum:

So you think the growth though is moving into more of a wellness lifestyle type situation as opposed to just a tincture that you take to help you sleep, or a tincture that you help to take with anxiety. This becomes more lifestyle related.

Connor Skelly:

Yeah. Companies will start to… And not just CBD brands, right? Other companies that want to enter the space, they will begin to look at, what are those other tangential products, lifestyles, services, things like that, that fit into an overall CBD consumer.

Matt Baum:

So what are you looking at? What kind of things do you think? What recovery drinks and protein stuff like that?

Connor Skelly:

Yeah, I mean, those are happening now. For sure. Back to the point around innovation, there’s been a ton of beauty products. Beauty and skincare has exploded this year. And-

Matt Baum:

Which seems odd, because no one can go out. We can’t do anything. Why do we need to be so beautiful.

Connor Skelly:

Self care. It’s self care man.

Matt Baum:

I stopped cutting my hair even, I was like, “Ah, screw it.”

Connor Skelly:

Yeah. So, we’ve seen the beverage space has been really big again, the growth of it is kind of artificially constrained by the FDA guidance right now. But all these different kinds of positionings focus towards recovery, focus towards energy, all these kind of aspirational need states that consumers have. CBD brands and other companies are getting better and better at starting with those need states and then figuring out, well what products… How do my existing products meet those needs? And if they don’t, where this will be going in the next year, or two, three years.

Connor Skelly:

They’ll say, “Well what other products can I create?” Maybe, what other brands can I partner with to create that experience for our customer?

Matt Baum:

That seems… And I don’t know, I don’t work in market research, but I do feel like I’ve seen a lot of these companies that are marketing to athletes, or to weekend warriors, and that seems to be where a lot of this is going. Gym culture, and health culture like that, where yeah, it’s just part of the deal. You drink your special drink and you get your CBD, and it helps you with your muscles and whatnot. Is that the way to go? Or is that going to get played out really quick here to?

Connor Skelly:

Not every brand’s going to do it. There’s going to be a lot of brands that, they perform really well in pharmacy, right?

Matt Baum:

When you say in pharmacy-

Connor Skelly:

They have a medical positioning for their brand. What’s that?

Matt Baum:

When you say they perform really well in pharmacy, how do you mean? Full on in a pharmacy like Walgreens type setting?

Connor Skelly:

Yeah, your Walgreens. They may have, whether it’s their entire product portfolio, or the company has created a separate brand geared towards a pharmaceutical audience. There’re many companies that are moving in that kind of direction, where they find that they could be channel driven, and then so they’ll create a brand, position their products differently around that specific channel, and the consumer behavior on that channel.

Matt Baum:

Fair enough.

Connor Skelly:

So that’s just one example. There will be a lot of brands that will continue to move more into this wellness, or active, or these other kinds of positionings. It will just kind of depend on how they want to grow as a company and where those overlaps are with their current consumers and their prospective consumers.

Matt Baum:

Okay. So let’s play, I’m a CBD brand. And I come to you. It’s been a rough year. Ugh, COVID. It’s killing me. What is the worst mistake that I made this year? What is the worst possible thing that you’ve seen brands doing, in your opinion? I want to go the opposite side of the spectrum, as opposed to, here’s what you should be doing. What’s the worst trend you’ve seen them do?

Connor Skelly:

Ignoring digital.

Matt Baum:

Really? All together ignoring? Just saying, “Nah, all we are is a brick and mortar?” That seems insane.

Connor Skelly:

Yeah like-

Matt Baum:

I can’t believe anyone’s doing that.

Connor Skelly:

And this doesn’t just apply to CBD, this applies to companies in general. There have been a lot of companies spending more money on social media and social listening tools. There are companies that are spending more on market research and things like that, because that’s what you do when market’s down. Is, you need data to back it up. The people that aren’t able to quickly meet their customers to where they are are in a lot of trouble.

Matt Baum:

Yeah. Okay. So, and they come to you. I’m struggling doing that. I’m having so much trouble. What do I do? What do you say to these clients that come in and they’re like, “I’m just screwed. I don’t know. I’m screwed.”

Connor Skelly:

Well, you use our data, you listen to us. No, no. So, CBD brand, for example, comes to us and say, “We’re steadily losing sales. We don’t have a problem getting people to come to our site, but they don’t convert.” Or things like that. Then, we could help them understand who their core consumers currently are and everything about them. From how they’re using those products, to basic things, demographics, usage, attitudes, all that.

Connor Skelly:

But then also, help them understand, well how are they talking about this stuff on social? What’s the context in which they talk about these things on social? What are the different points in their journey that you can continue to educate them? Because that’s very important, consumer education. What’s the right way to educate them for your brand and the brand direction that you want to go?

Matt Baum:

There you go, yeah.

Connor Skelly:

And-

Matt Baum:

Because there’s things you can tell them, but there’s also a right way to tell them these things, and a wrong way as well too, so.

Connor Skelly:

Right. And especially early on, it’s just kind of this buckshot thing where it’s like, “Well we’re just going to put this out and kind of see, and put it out in a bunch of different places and kind of see what happens.”

Matt Baum:

Right. We’ll tweet about it, we’ll talk about it on Instagram, whatever. But God, there’s so many. Like you said, there was 3,500 that you were tracking. And they’re all doing that. It just seems like, at first, we talked a lot about extraction. And then we talked a lot about the carrier, what kind of oil are they using? Or what kind of pill is it? Or whatever. And then we talked about specific things. Well this product will help you sleep. Or this product… CBG is a new one that we’re learning about.

Matt Baum:

Is it that differentiation where everyone’s going to… You spoke earlier, saying CBN seems to be popping up. Is CBG doing something similar? Is that coming up? And do you think-

Connor Skelly:

Yeah, it definitely is. I think C-

Matt Baum:

Do you think that differentiation is because of where we’re at?

Connor Skelly:

What’s that?

Matt Baum:

That differentiation, is this also just because where we’re at? Everyone is trying to survive right now and carve a niche?

Connor Skelly:

Yeah, I mean I would say, especially with CBG, where the positioning on it isn’t 100% defined. And-

Matt Baum:

Right. That seems like a really tough one right now. Because-

Connor Skelly:

It does-

Matt Baum:

We know it’s a thing. We just don’t necessarily know what that thing totally does.

Connor Skelly:

Right. And that goes with all of them, right? But to me, the positioning on CBG has always kind of been more wellness. Which, to the right consumer, there is nothing wrong with that. If you’re able to position your product of, this has enhanced wellness features or properties, that’ll be music to their ears, and those products will perform well with those consumers.

Connor Skelly:

So I think that’s kind of one of the areas where the industry is advancing right now, and how, they may have a tough time, or they may not need to position their products any differently than they do now. But if they want to be more innovative and have their positioning of those products, a lot of them are using cannabinoids to do so, especially as the cost of hemp decreases. I’m assuming, and I’m guessing, that over the next year or two years it’s going to become a very complex brand and consumer targeting space. Yeah.

Matt Baum:

Right, as you start to drill down into this and decide… And again, not making health claims, but CBG helps with X, or it’s really good for Y type of person, you’re going to start to get into more very much directed marketing to that. Whether they’re athletes, or they’re senior citizens, or they’re kids with anxiety, or something. What do you think, next year, what do you see as… And again, we’re forecasting here, no one’s saying go bet on what he says folks, you heard it here. There’s your hot tip. But what do you see trending up next year?

Connor Skelly:

Well, with FDA guidance likely getting figured out by middle of next year, that’s going to open the floodgates.

Matt Baum:

Food and beverage you think more than anything? Or do you think it’s going to maintain a larger business in the tinctures and pills and whatnot? Because I would think, you’ve got companies, there’s no way Coca-Cola isn’t just waiting for some FDA so they can go, “Boom, we put it in Gatorade, we put it in Diet Coke, we put it in this.” I mean, I would guess that market is, I mean, just massive, absolutely massive.

Connor Skelly:

Yeah, I think, take that new product from Pepsi, Driftwell, right?

Matt Baum:

Oh, I don’t even know what that is.

Connor Skelly:

I don’t know if you saw that.

Matt Baum:

No.

Connor Skelly:

It’s a sparkling beverage that has calming properties in it. There’s no CBD in it.

Matt Baum:

Oh.

Connor Skelly:

There’s no CBD, there’s no hemp in that product. But that’s definitely where I see these companies going.

Matt Baum:

Do you see that-

Connor Skelly:

I think they’re going to use their existing… their brand prowess, their distribution prowess, they’re going to use all of this to really target after those need states of consumers. And they’re going to do it significantly better than a lot of these CBD brands have. Now, a lot of those top CBD brands, they have done extremely well on it. And some of them, they may be looking to be acquisition targets, they may want to still compete against all those big CBG companies, and they very well could. It will be a very brand-centric space.

Matt Baum:

So do you think, you said next year sometime when FDA… I mean, phew, fingers crossed, the FDA figures this out and gives us rules for this.

Connor Skelly:

Fingers crossed next year it happens.

Matt Baum:

Yeah, no doubt. I’ll believe it’s there when we get their friend, okay? But as soon as these FDA rules come in and you start to see major players come in, is it going to turn into what we see with microbrews getting famous and then getting purchased by Coors, and all of a sudden it’s like, yeah, they still maintain this type of beer or whatever, but it’s not really them anymore? Is that what’s next for these companies? Blow up, get acquired, make your money, start a new company?

Matt Baum:

That seems to be what happened in brewing in the United States as beer got more and more popular, and microbrews got more and more popular. The idea was, go get bought. That seems like the next frontier, to me, for a lot of these CBD, CBG, CBN companies. Get acquired, so now you’re still your company, but it’s your company CBD in Gatorade, for example, or something.

Connor Skelly:

Mm-hmm (affirmative). I think there’s definitely a lot of brands that, they want to be acquisition targets. There’s a lot of those founders, they’ve put in a lot of the work for all these years and they saw the space moving this direction. And they want to get acquired by Pepsi, right? There’s nothing wrong with that. And they should absolutely make sure that they have a strong brand and a strong connection with their consumers, so then it’s an easy sell to them.

Connor Skelly:

I think there’s also a lot of these top brands, aren’t going to want to give up their seat, right? They have very established relationships with consumers, like I said earlier, trustworthy, high quality products are some of the top brand descriptors that we get from consumers. And a lot of those top brands, they rank highly for those descriptors. And so when you bring in another brand, say like a Coca-Cola or a Pepsi that have strong brand affinities across a wide range of consumers, the jury’s kind of still out on, are they going to be trustworthy on a CBD side?

Matt Baum:

Yeah. The exact opposite, it could turn a lot of people off that are into this sort of wellness ideal, and they look at major companies like Procter & Gamble getting involved, that’s scary, I’m out. I’m not touching… Boulevard got bought by Coors for example, Boulevard Brewery-

Connor Skelly:

Or-

Matt Baum:

… and a lot of people said, “I’ll drink something else, thanks.”

Connor Skelly:

On that kind of same token, it could just strengthen the relationship that those consumers have with their existing CBD brands. So, over the past few months we were starting to see brand loyalty grow a bit more, brand preference grow a little bit more across different attributes and descriptors, and there’s a good amount of evidence to show that CBD consumers, they may want to stick with their current brands, even if a larger company enters the space.

Matt Baum:

Sure. It does seem like we’re in a space right now with CBD where, again, we don’t have a lot of government oversight. And so it can be hard to find good quality CBD. And when you do, yeah, people go, “That’s the one. I don’t want any other one, I want that one. I’m sticking with it.” And that can also be good and bad, in the sense that it’s like, a company goes out of business, well what do they do? Maybe they go, well screw it, I’m going to try something else then. Because I can only trust those one guys.

Matt Baum:

Is there a danger there of, when this starts to get regulated… I mean, I want regulation. We need regulation. If nothing else, so we can see these people are doing it right, these people are doing it wrong. Do you see any sort of day of reckoning coming, if you will, like an armageddon almost that is going to shake out a lot of these companies? And the strong are going to survive and the others will just go into the next Wild West whatever?

Connor Skelly:

I think a lot of that has already happened.

Matt Baum:

Really?

Connor Skelly:

Especially with last year and COVID accelerating a lot of the big shakeout. A lot of that has already happened. And I think the top players will continue to strengthen, even though there’s… Across different channels, like independent pharmacies are online, are still highly competitive. The entire industry is highly competitive. But there are certain channels where top 10 brands could look very different-

Matt Baum:

Yeah definitely.

Connor Skelly:

… in a year from now. So no, I don’t think there will be this kind of reckoning in that sense. But when these CBG companies… What these brands should be doing now is, using this time before FDA guidance wisely. That’s been a big talking point to CBD brands that we have had-

Matt Baum:

Get ready for it.

Connor Skelly:

… for the past year. Is like, use this time to your advantage. Continue to build up a strong brand, continue to develop… set the foundation for long term relationships with your customers, listen to them, meet them where they are, and you’ll be well set up to effectively compete, or be ready for an acquisition target.

Matt Baum:

So, still a good time to get in the business. It’s not as scary as we all thought. Because I honestly, I didn’t think you were going to come in and be like, “Oh, doom and gloom. Oh, good lord.” Right? But it’s scary and a little more complex right now. But would you say, still a pretty good time to get in the business if you’re going to do it right?

Connor Skelly:

I think so, yeah. I mean, we’re seeing a lot of bounce back from Q2, and I definitely want to acknowledge the hardship and a lot of the challenges that all brands, and especially the brick and mortar ones have faced over the last year. We absolutely have to. You can’t negate that.

Matt Baum:

No, no, of course not.

Connor Skelly:

But as we’re progressing, and through 2020 and into next year, economies are opening back up, and we’re seeing, in Q2, we saw a steep decline in new users entering the category.

Matt Baum:

Definitely, yeah.

Connor Skelly:

Compared to last year.

Matt Baum:

I’m sure.

Connor Skelly:

And we’re starting to see that number come back up. And those that are heavy users have been steadily decreasing since last year.

Matt Baum:

Really?

Connor Skelly:

Or, sorry, steadily increasing since last year. And so-

Matt Baum:

Okay. Okay, because I was going to say, this year has been so awful that I’ve needed by CBD more than ever.

Connor Skelly:

Yeah. And we started asking questions related to COVID to our cannabis and CBD respondents, end of Q1, and the most recent data that we got showed that 75% agreed that this helped them through the pandemic.

Matt Baum:

Definitely.

Connor Skelly:

And so that usage continues. New users are coming back in. And close to 50% of respondents are saying that they’re starting to purchase their CBD in store again.

Matt Baum:

That’s great.

Connor Skelly:

Yeah. And so-

Matt Baum:

That’s really great.

Connor Skelly:

… what’s also interesting is, yes, they’re starting to purchase in store again. But we saw, it was something like, roughly 20, 22% I think, in Q1, purchased online. It more than doubled to Q2.

Matt Baum:

I would guess.

Connor Skelly:

Of people purchasing online. And that’s continued to stay strong. So that’s going to continue to be a strong channel for brands.

Matt Baum:

Awesome. This has been fantastic, and it’s not something I really get to talk about. Usually we’re talking about processes, or we’re talking about quality, or we’re talking about this cool cloth that could replace cotton someday, who knows? And it’s really interesting to talk about this from a market perspective. Because I mean, you wouldn’t think about it so much because it is CBD, and it seems like this separate thing, and it’s still new and ever. But, you have to market it just like anything else. And you’re selling it to people. And people are going through a tough time right now, and that means it’s going to be a tough financial time for all kinds of markets and whatnot.

Matt Baum:

Huge thanks to Connor for coming on the show and giving me a chance to have a conversation that I haven’t really had. It’s amazing that marketing firms really are paying attention to this market, because it is huge. And while it has been struggling, it was really nice to here somebody like Connor, who is deeply entrenched in this, with such a positive outlook for what comes next. And for companies that are doing it well. And, not to mention the fact that he seems to think the FDA is going to figure it out sometime next year, which would be good news for everyone involved.

Matt Baum:

Well, that about brings us to the end of another episode of The Ministry of Hemp Podcast. I’ll have links to the Brightfield group in the show notes. And speaking of show notes, we here at the Ministry of Hemp believe that an accessible world is a better world for everybody. So, you will find a full written transcript of this show in the notes as well. Next week, I promise, we’re going to get to that show about Delta-8-THC, I finally have locked down an expert. And I’m super excited to talk to them. Not just that, I am going to take Delta-8-THC and let you know about my experience right here on the show.

Matt Baum:

If you’re looking for more hemp news and information right now, head over the ministryofhemp.com where we have a Delta-8 fact sheet you can check out to prepare for the episode I keep telling you is coming. Sorry about that. And, we have a brand new Ministry of Hemp verified seal that we are giving to cool brands that we’ve reviewed, and researched, and talked about. So, if you see that seal, the Ministry of Hemp verified seal, it’s green, it’s really cool, you got to check it out, you know we’ve done the hard work for you. And, this is a brand that you can trust. We wanted to do something to help you, the consumer make good choices with your money while we’re waiting for FDA regulation. It’s a cool stamp, and I even suggested we make t-shirts of it. So let me know what you think.

Matt Baum:

If you want to help support hemp education and spreading the word of hemp education, head over to patreon/ministryofhemp and become a Ministry of Hemp insider. It gets you access to all kinds of cool stuff, like this weeks podcast extra, where I am talking to Connor about how a marketing guy ends up working in cannabis. It’s a fun little conversation. And, you get so many other things too, like early access to articles, and extras that we don’t even put on the site. Not to mention the fact, in doing so you are directly helping us spread the word, keep the site alive, and keep this show going. Please head over to patreon/ministryofhemp and become an insider today.

Matt Baum:

Well that about does it for me. I’m about to go huddle in front of the television all night and hope for good news in the election results. We’ll see. Either way, we’ll be back here next week, and we’ll deal with it, one way or another, I promise. You’re not alone. And the good news is, there’s things like CBD to help you with your anxiety if you need it. For now, remember to take care of yourself, take care of others. I hope you voted, because it’s your patriotic duty to do so, and I hope you made a good decision. This is Matt Baum in the Ministry of Hemp, signing off. (silence).

Before it became known for tobacco growing, Kentucky was the heart of American hemp. Today, Kentucky is again becoming a leader in U.S. hemp....

Portable THC testing equipment could allow police to determine whether a sample of cannabis flower is hemp or illegal psychoactive cannabis (“marijuana”), potentially avoiding...

A new techology called a “cocrystal” could improve our ability to absorb CBD oil. Welcome to episode 62 of the Ministry of Hemp Podcast....